AI credit repair software is an innovative technology and data analytics to streamline and enhance the credit repair process. It can quickly and accurately identify errors, inaccuracies, and areas for improvement in credit reports. Thus, allowing for more efficient and effective solutions.

By automating many of the once time-consuming tasks, AI credit repair software is bringing a new level of precision and speed to the industry. It provides you with improved access to credit and financial opportunities. This guide will explore how AI reshapes the credit repair landscape and its impact on the industry.

In this article

Understanding AI Credit Repair

AI credit repair is a financial technology solution designed to assist you in enhancing your credit profiles. It represents a significant departure from traditional credit repair methods. This innovative approach utilizes data analysis and automation to identify errors in credit reports.

These are all done while offering tailored strategies for credit improvement.

It systematically identifies inaccuracies, outdated information, and other negative factors impacting an individual's credit score. Once these issues are pinpointed, the AI system generates custom dispute letters and initiates correspondence with credit bureaus and creditors.

Thus, expediting the dispute resolution process. Additionally, AI credit repair offers real-time monitoring of credit profiles and delivers personalized recommendations to help make informed financial decisions.

The Benefits of AI Credit Repair Software

The adoption of AI credit repair software has its benefits:

Benefit 1: Improved Accuracy and Efficiency in Credit Repair

AI credit repair software excels in pinpointing discrepancies within credit reports. This saves you valuable time and ensures that all relevant issues are appropriately addressed. Thus resulting in a more accurate representation of your creditworthiness.

Benefit 2: Enhanced Personalized Recommendations

AI algorithms analyze your credit profiles and financial behavior to generate highly tailored recommendations. These suggestions empower you to make informed decisions. This might include debts to prioritize, credit optimization, and when to apply for new credit. This personalized guidance can be invaluable for those looking to maximize your credit score improvement potential.

Benefit 3: Reduced Human Error and Bias

One of the inherent challenges of manual credit repair processes is the potential for human error and bias. AI credit repair software operates objectively and without bias. This ensures disputes are based on factual information rather than subjective judgment. This reduces the risk of disputes being rejected due to inconsistencies or inaccuracies.

Benefit 4: Timely and Proactive Monitoring

AI credit repair software provides real-time monitoring of credit profiles. It alerts you to any changes or updates in their credit reports promptly. This proactive approach enables you to stay vigilant and take immediate action in response to negative developments.

Benefit 5: Enhanced Accessibility and Affordability

AI credit repair software is often more accessible and cost-effective than traditional credit repair services. It allows a broader spectrum of individuals to access credit repair assistance.

AI Credit Repair vs Traditional Methods

The emergence of AI-driven credit repair has introduced many benefits and efficiencies that set it apart from traditional methods. But it's essential to acknowledge the limitations of AI and the continued importance of human expertise in the process:

AI Credit Repair:

- Speed and Efficiency: AI credit repair excels in speed and efficiency. It can analyze data and generate dispute letters rapidly.

- Accuracy and Objectivity: AI software operates objectively, reducing the risk of subjective biases in traditional credit repair services. It analyzes credit reports based on data and facts.

- 24/7 Availability: AI systems provide round-the-clock access. You can monitor credit profiles and receive real-time updates and recommendations.

Limitations of AI in Credit Repair:

- Lack of Human Judgment: AI lacks the nuanced human judgment that can be valuable in certain credit repair situations. It may struggle to handle complex cases that require a personalized touch.

- Inability to Negotiate with Creditors: While AI can identify and dispute inaccuracies, it may not negotiate directly with creditors or debt collectors.

- Data Limitations: AI's effectiveness relies on the quality and quantity of data available. AI may face limitations in generating accurate recommendations in incomplete or outdated credit reports.

Traditional Credit Repair:

- Expertise in Complex Cases: Traditional credit repair services excel in managing complex cases that demand human expertise. These situations often involve negotiations requiring an in-depth understanding of the credit landscape.

- Tailored Strategies: Human credit repair experts can craft highly personalized strategies tailored to a client's financial situation, goals, and challenges. AI may not encompass the full range of individualized factors when making recommendations.

- Legal and Regulatory Expertise: Credit repair involves complex legal and regulatory considerations. Traditional experts are well-versed in navigating these problems, ensuring all actions adhere to the law.

Legal and Ethical Considerations of Credit Repair

1. Compliance with Credit Repair Regulations

Credit repair is subject to a complex web of federal and state regulations, the most prominent being the Credit Repair Organizations Act (CROA) at the federal level in the United States. AI credit repair and traditional services alike must adhere to these regulations. These include requirements for transparency, disclosure, and the prohibition of misleading or false information.

2. Protecting Consumer Data and Privacy

The handling of sensitive data is a fundamental concern. AI credit repair software and traditional credit repair agencies must implement robust data protection measures. This involves securing personal and financial information against prohibited access and ensuring compliance with data privacy laws, such as the GDPR in Europe and the HIPAA in the United States.

3. Addressing Potential Biases and Discrimination

AI and traditional credit repair services should be vigilant in identifying potential biases and discrimination in the credit repair process. AI algorithms can perpetuate biases present in historical credit data. It regularly audits and adjusts AI systems to mitigate these biases and ensure fairness. Similarly, human credit repair experts must operate without bias or discrimination.

4. Transparent and Ethical Practices

Transparency and ethical conduct are foundational in credit repair. Service providers must be upfront about their methods, fees, and expected outcomes. Misleading promises or hidden fees can lead to legal issues.

Utilize Dispute AI for a More Secure AI Credit Repair

As AI credit repair software continues to revolutionize the financial industry, it's important to acknowledge that even the most advanced AI systems can encounter occasional inaccuracies in credit reports. To address this, Dispute AI (an AI credit repair software) ensures a more secure credit repair experience. It simplifies the process that adheres to “consumer protection laws,” enhancing your dispute effectiveness.

Dispute AI secures against inaccuracies that may arise in the AI-driven credit repair process. This tool is designed to swiftly and efficiently address discrepancies or errors that may compromise the effectiveness of credit repair efforts. By seamlessly integrating Dispute AI, you can enjoy a more secure and accurate path to improving your credit profiles.

Key Features of Dispute AI:

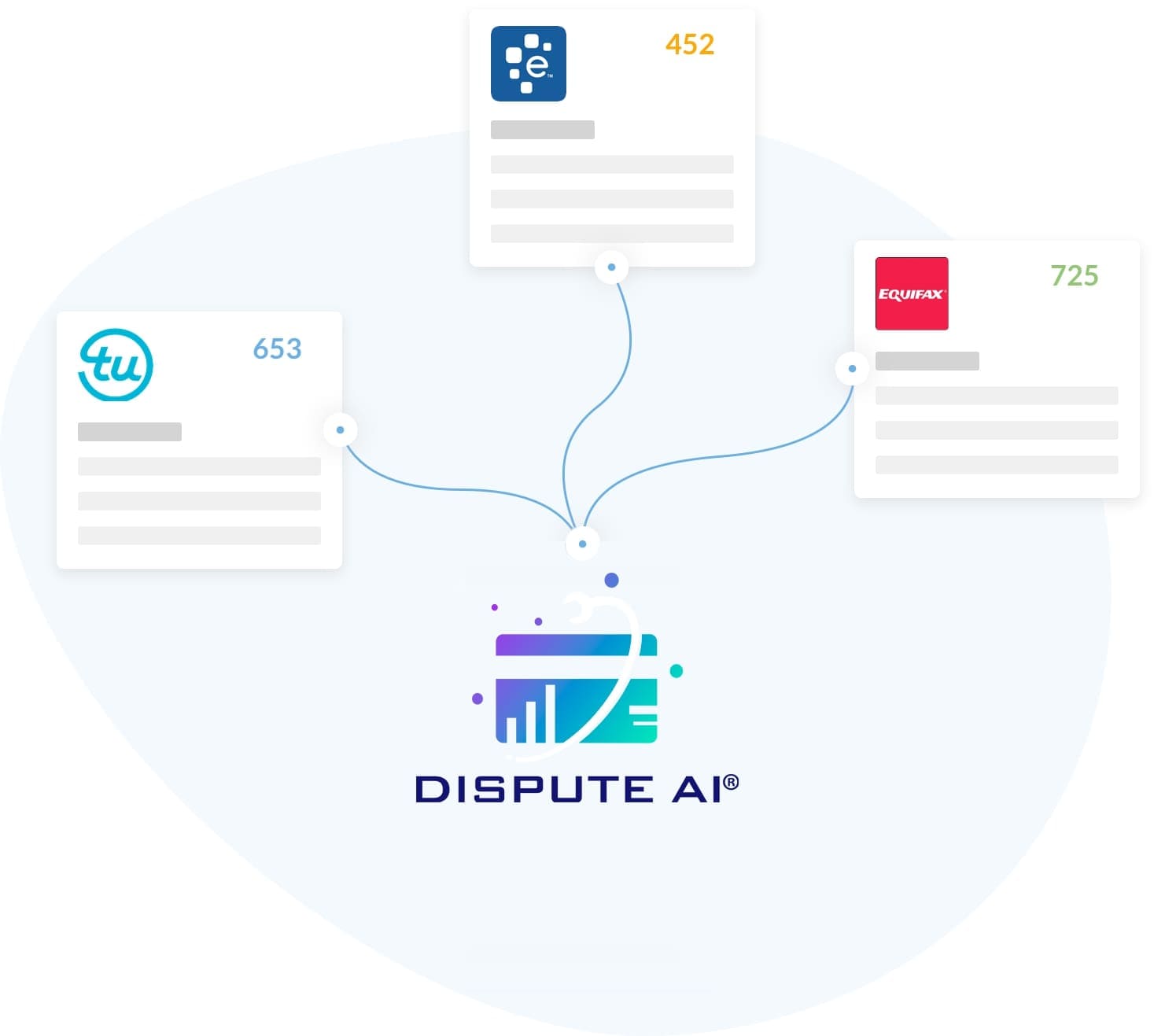

- Smart Import: Dispute AI effortlessly imports your tri-bureau credit report without triggering a formal credit inquiry.

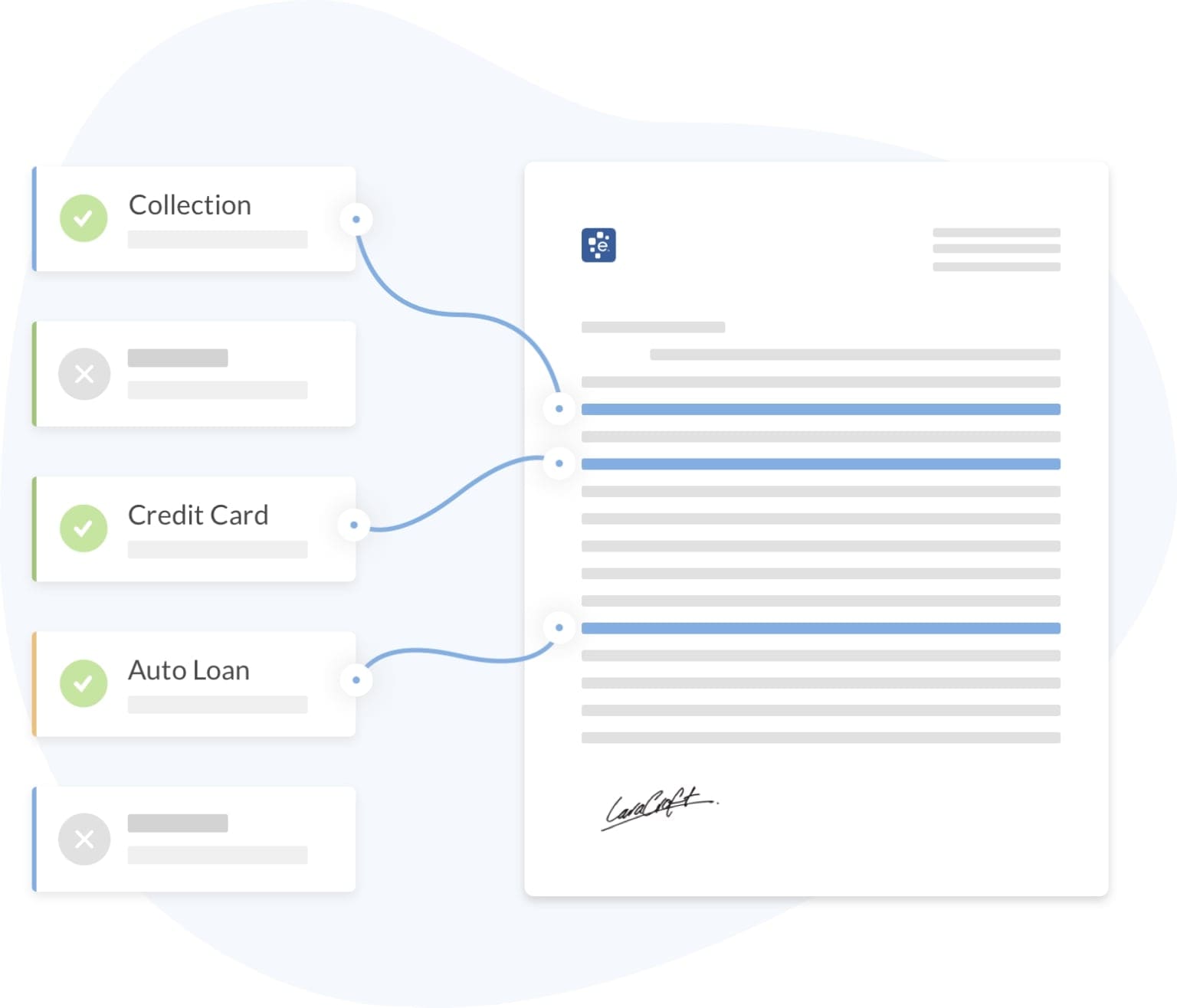

- Smart AI Integration: Dispute AI's Artificial Intelligence identifies accounts that negatively impact your credit. It assists you in crafting effective dispute requests to have them removed.

- Track Results: Monthly, Dispute AI imports your updated tri-bureau credit report. It displays the accounts successfully removed and your updated credit scores. If an account remains unresolved, it will propose a new approach for further dispute actions.

Step-by-Step Guide:

Step 1: Link your credit report. Dispute AI automatically imports and analyzes your 3 bureau credit reports, finds negative accounts, and prepares an aggressive dispute strategy.

Step 2: Dispute AI’s AI knows that different negative accounts require different dispute strategies. For example, disputing a collection account is different than disputing a bankruptcy. It helps you create the right dispute to achieve a permanent deletion.

Step 3: The tool will track all your disputes on all 3 credit bureaus. You’ll receive a monthly progress report showing what accounts were deleted and your new credit scores.

How AI is Changing the Video Repair Industry

Historically, repairing video content was a manual and a time-consuming process. However, AI's impact is undeniable, primarily through its capabilities in automated error detection, efficient repair, and scalability. AI algorithms can swiftly recognize video issues, resulting in rapid and precise error detection. Moreover, AI not only identifies problems but also offers efficient repair solutions, filling in gaps in missing frames, reducing noise, and enhancing overall video quality.

This transformative technology is making video repair faster, more cost-effective, and consistent in quality. Hence, revolutionizing the way we approach video content restoration and improvement in the digital age.

Wondershare Repairit, alongside other AI-driven technologies, is at the forefront of transforming the video repair industry. Repairit automates error detection, enabling it to swiftly identify video issues. It is known for its versatility and extensive application in data repair, making it a dependable choice for you to restore your valuable data.Features

- With over 20 of experience in data repair and recovery, the Repairit product team has harnessed its expertise to develop a range of cutting-edge patented technologies. These include the Sample Polling Algorithm and the Adversarial Generative Network to guarantee the highest quality of file repair.

- Occurrences such as unexpected power fluctuations, system crashes, update mishaps, and more can corrupt videos, photos, or various file types. Repairit is equipped to address these corruption situations.

- With several advanced data repair technologies and an extensive sample database, Wondershare Repairit has assisted over 2 million users in recovering their corrupted data globally.

Conclusion

AI Credit Repair Software is changing how we fix our credit. It uses smart computer programs to make the process faster and more accurate. This means it's cheaper for people and gives them more control over their credit repair.

AI software will become even easier to use as time passes, helping more people. Like Dispute AI, an AI credit repair software, it improves your financial future. Moreover, Wondershare Repairit, a video repair tool, helps you repair important videos in just a click. They redefine the industry by incorporating artificial intelligence towards a hassle-free future.

FAQ

Can AI Credit Repair Software guarantee credit score improvement?

While AI Credit Repair Software is highly effective, it cannot guarantee specific credit score increases. Its outcomes depend on individual credit histories and the accuracy of disputes.Is AI Credit Repair Software safe and secure for handling sensitive credit information?

Reputable AI Credit Repair Software providers prioritize data security, employ encryption, and protect sensitive credit information.Can AI Credit Repair Software work for all credit situations?

AI Credit Repair Software is adaptable but may not resolve every credit issue. This is especially true from more complex financial challenges.

![AI Credit Repair Software Overview [Including Dispute AI]](https://images.wondershare.com/repairit/article/ai-credit-repair-1.jpg)

ChatGPT

ChatGPT

Perplexity

Perplexity

Google AI Mode

Google AI Mode

Grok

Grok